Home Mortgage Tips That You Can Utilize

Article writer-Berger RichMany people want to have a home of their own. Becoming a homeowner carries a lot of pride with it. However, very few are able to pay for a home outright; a mortgage is typically necessary. The article below tells you what you need to know before you apply.

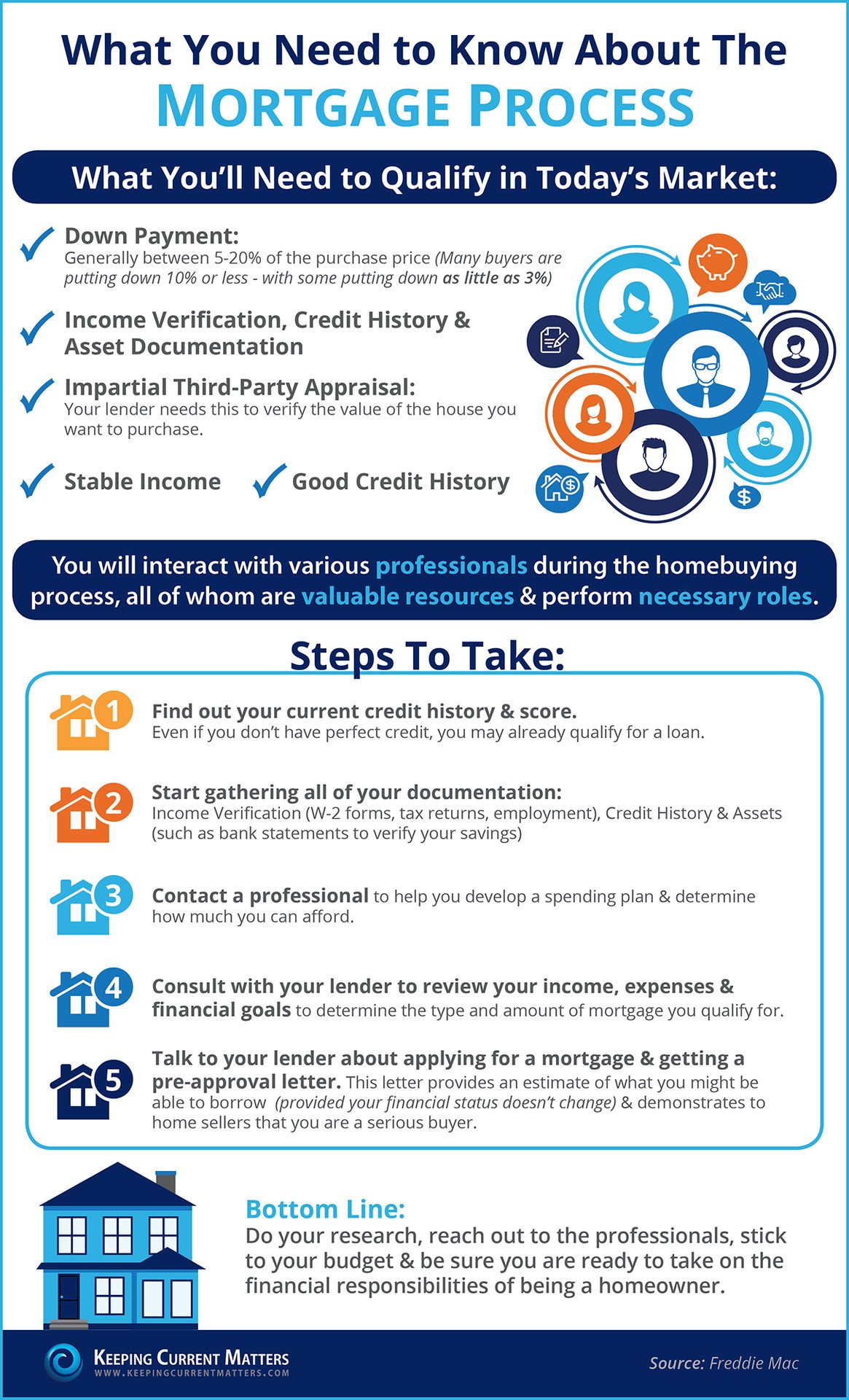

Understand your credit score and how that affects your chances for a mortgage loan. Most lenders require a certain credit level, and if you fall below, you are going to have a tougher time getting a mortgage loan with reasonable rates. A good idea is for you to try to improve your credit before you apply for mortgage loan.

Avoid fudging the numbers on your loan application. It is not unusual for people to consider exaggerating their salary and other sources of income to qualify for a larger home loan. Unfortunately, visit the up coming site is considered froud. You can actually be criminally prosecuted, even though it doesn't seem like a big deal.

Pay down your debt. You should minimize all other debts when you are pursuing financing on a home. Keep your credit in check, and pay off any credit cards you carry. This will help you to obtain financing more easily. The less debt you have, the more you will have to pay toward your mortgage.

Never take out a new loan or use your credit cards while waiting for your home mortgage to be approved. This simple mistake has the potential of keeping you from getting your home loan approved. Make sacrifices, if need be, to avoid charging anything to your credit cards. Also, ensure each payment is received before the due date.

Consider unexpected expenses when you decide on the monthly mortgage payment that you can afford. It is not always a good idea to borrow the maximum that the lender will allow if your payment will stretch your budget to the limit and unexpected bills would leave you unable to make your payment.

Before you sign for refinancing, get a written disclosure. This usually includes closing costs as well as fees. Most lenders are honest from the start about what is going to be required of you, but a few do sneak in charges that you don't discover until the deal is done.

While you wait to close on your mortgage, avoid shopping sprees! Lenders tend to run another credit check before closing, and they may issue a denial if extra activity is noticed. recommended site should be put off until after your mortgage application has been approved.

Save your money. When you are going to finance a home mortgage, you will need to have some cash for a down payment. The more money you pay down, the lower your payments and interest rates. The down payment goes directly to the principal of the mortgage and is a sum you will not owe yearly interest on.

Look closely at lenders. There are many companies willing to lend you money to finance your home. They are not all equal. Look into the reputation of the lender and try to talk to people who have their loans through them. Reputations are hard to hide, and you will want to know how your potential lender handles business.

Some financial institutions allow you to make extra payments during the course of the mortgage to reduce the total amount of interest paid. This can also be set up by the mortgage holder on a biweekly payment plan. Since there is often a charge for this service, just make an extra payment each year to gain the same advantage.

Understand how you can steer clear from home mortgage lenders who are shady. Bad mortgage practices can end up costing you a lot of money. Don't fall for fast talkers. Don't sign loans with unnaturally high rates. A lender who boasts of being successful working with low credit scores is someone you want to stay away from. Finally, never lie on an application, and watch out for lenders who tell you otherwise.

Never assume that a mortgage is going to just get a home for you outright. Most lenders are going to require you to chip in a down payment. Depending on the lender, this can be anywhere from 5 percent to a full fifth of the total home value. Make sure you have this saved up.

Get at least three mortgage offers before deciding on which one to go with. Home mortgages, like many other loans, will vary in their costs and rates from lender to lender. What you think is a good deal may not be, so it's important to see multiple options before making a decision.

Speak with a broker and ask them questions about things you do not understand. It is your money. You have to understand fully what is happening. Be sure the broker has your contact information. Check your email on a regular basis to see if they need any documentation or information updates.

Getting a secured interest rate is important, but there are other things to think about. Each lender has various miscellaneous fees that can drive your cost up. Consider closing costs, points and the type of loan they are offering. It pays to solicit quotes from multiple lenders before deciding.

Be sure that you know exactly how long your home mortgage contract will require you to wait before it allows you to refinance. Some contracts will let you within on year, while others may not allow it before five years pass. What you can tolerate depends on many factors, so be sure to keep this tip in mind.

Look through the internet for your mortgage. Though most mortgages used to be from physical locations, this isn't the case any longer. There are a lot of great lenders online that only do their business on the Internet. They have the advantage of being decentralized and are able to process loans more quickly.

Never choose a home mortgage from a company that asks you to do unscrupulous things. If a rep is asking you to claim more than you make to secure the mortgage, it's not a good sign that your mortgage is in good hands. Walk away from these deals as quickly as you can.

Having this solid training in hand, start your search now. Apply this advice to find the perfect lender for your needs. Whatever type of mortgage you need, you are now able to go out there and get it.